Why Thala Labs is a Sleeping Giant and How It Could Be Awaken

Just like Samsung was a pillar of growth for Korea, Thala Labs has the potential to be the driver for growth for Aptos and the overall Move language ecosystem.

Context

Back in 2022, KST Capital, invested in Thala Labs as part of their $6 million seed round. I’ve written a little research on what products Thala Labs offer and also why they have a strong case to be a leading DeFi lab to be on the lookout for.

Intro

As new blockchains emerge, it's crucial to establish a foundation with products that cater to the needs of users and drive initial adoption. This scenario is unfolding with Aptos, an innovative Layer 1 blockchain, and Thala Labs, an Aptos-native research organization focused on producing DeFi primitives.

With the wide range of products in the Thala Labs suite, we believe the team has the potential to become the largest native DeFi Lab on the Aptos network, migrate to other Move-based chains, and perhaps be adopted by the broader DeFi ecosystem.

Primer on Aptos

Aptos is a high-throughput, low-latency L1 scaling solution designed to empower developers to build efficient and user-friendly applications. Aptos was built using the Move programming language, which is secure, fast, and expressive, and has a framework that simplifies the development process.

Among Aptos/Move’s most notable features is its parallel execution engine, Block-STM which transforms the traditional sequential processing of transactions into a parallel processing approach, allowing for faster transaction processing.

Since its launch on mainnet, Aptos has proven to be an ideal space for both builders and users. Developers benefit from an optimal environment for creating intuitive dApps and experiences, while the blockchain's underlying architecture ensures fast time-to-finality (TTF) and scalability, supporting widespread user adoption.

Aptos Labs, the organization behind Aptos is on a mission to make Web3 and dApps accessible to everyone. To make this happen, they're working on increasing TPS and achieving faster finality. As part of enhancing its current technology, Aptos Labs has conducted industry-leading research on upgrades to AptosBFT (Aptos’ current consensus protocol), and its other related technologies including:

Bullshark = DAG BFT protocol

Narwhal = DAG-based Mempool protocol

Tusk = DAG-BFT-based consensus algorithm that enables higher throughput

Shoal = framework for enhancing any Narwhal-based consensus protocol that significantly reduces latency and, eliminates the need for timeouts in deterministic practical protocols.

Aptos On-Chain Metrics

Monthly Active Accounts: 1.43m accounts.

Transactions to Date: 318m+

TVL: $122.02m (up 248% YTD)

The Move Language

The Aptos blockchain is built using the Move language which was first developed by Diem (formerly known as the Libra Project). Diem, initially backed by companies like Facebook, Uber, Visa, and Andressan Horowitz, led to the creation of Move, a blockchain language aimed at facilitating adoption by Web2 builders.

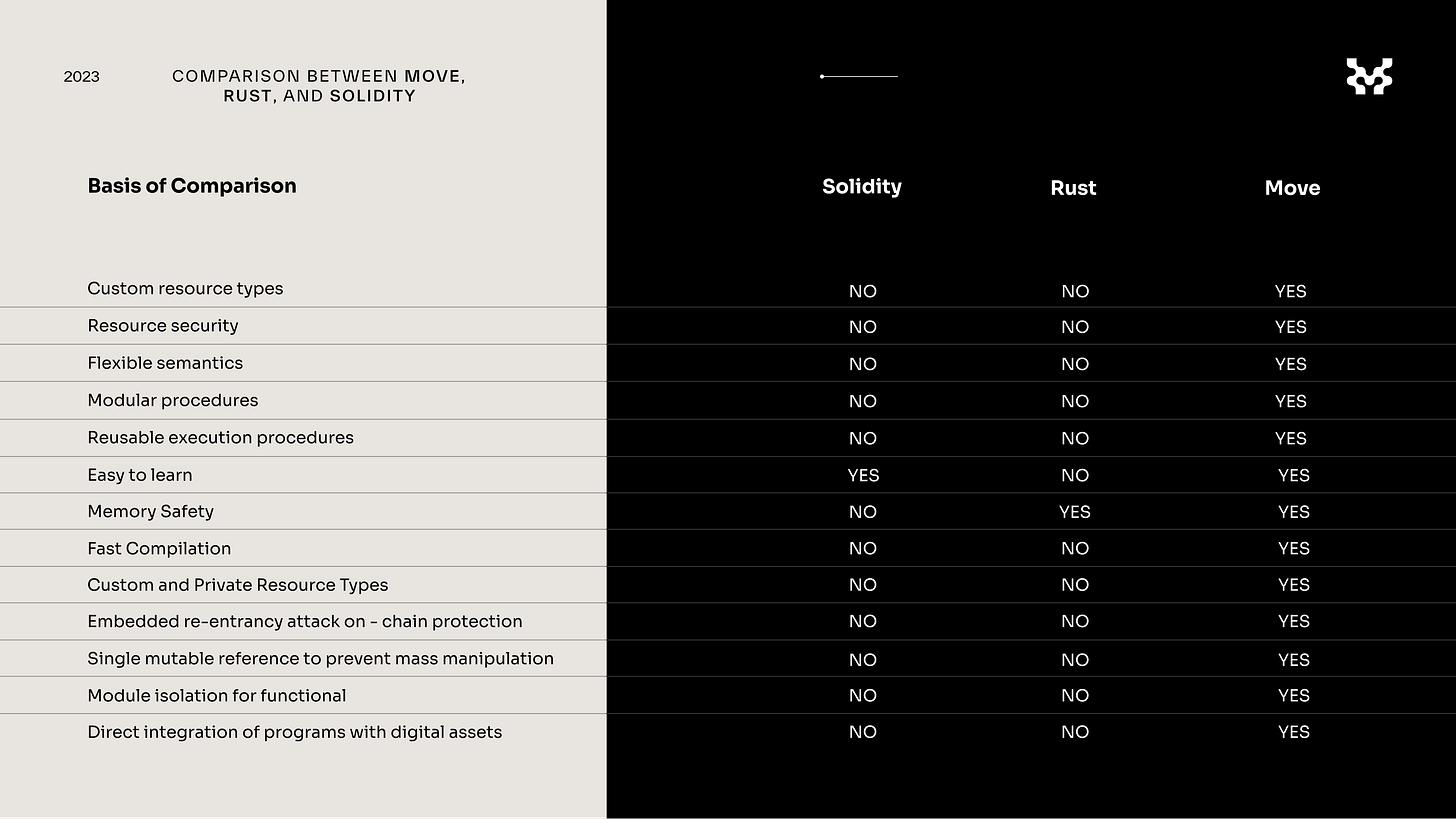

Move introduced improvements to blockchain dApp development in four key areas:

First-class resources: Developers can create custom resource types with semantics based on linear logic, ensuring resources cannot be copied or discarded without permission.

Flexibility: Move's object-oriented model, akin to C++ and Java, streamlines adoption for traditional developers, fostering increased contributions to the ecosystem.

Safety: Move contracts use a bytecode verifier that checks transacation data for resource, type and memory safety.

Verifiability: The Move language was designed to integrate off-chain static verification tooling, something.

See here for more comparisons between the Move language, Solidity and Rust.

Source: Movement Labs

Introducing Thala Labs

A fundamental requirement for any ecosystem is dependable platforms where users can actively engage with their tokens, earning yield, participating in governance, and exploring other essential use cases.

To develop Aptos’ ecosystem, Thala is pioneering multiple projects to increase developer adoption and bring the Aptos DeFi ecosystem up to speed with essential dApps for Aptos’ existing and potential users.

Positioned as the leading protocol in TVL on Aptos, Thala currently controls USD 80.84m in total TVL compared to the next largest protocol, Amnis Finance, which has USD 33.43m in TVL.

Thala Labs Team

Adam Cader - Co-Founder - Ex-ParaFi Capital

Mo Shaihk - Co-Founder - Ex- Meta, BCG, Blackrock, Consensys

0xbe1 - Lead Developer - Ex- Messari, Twitter, Google, Amazon

QZQ Samuel - Developer - Ex-Microsoft, Chronium

Thala Labs investors

Listed below are some of Thala’s Cap Table:

ParaFi Capital

Shima Capital

Bixin Ventures

Signum Capital

SeraFund

Saison Capital

White-Star Capital

DCF God

KST Capital

The Thala Labs Product Suite

ThalaSwap - Aptos’ Premiere DEX

ThalaSwap is a DEX enabling users to swap their crypto assets on the Aptos network seamlessly. Protocol revenue is generated through swap fees of which 20% goes to the protocol and the remaining 80% goes to LPs.

The platform’s core functions are comprised of:

Thala AMM (Automated Market Maker) — allows users to exchange assets

LP Pools — allows users to provide liquidity and earn fees from swaps

Flash Loans — allows users to borrow funds without collateral as long as they can return the funds within the same transaction.

At the core of ThalaSwap are its liquidity pools (LPs) where users can provide assets for others to swap using Thala’s AMM. In return for providing liquidity, LPs earn yield from swap fees.

ThalaSwap Liquidity Pools

Thala Swap supports three types of pools:

Weighted Pools

Stable Pools

Liquidity Bootstrapping Pools

Weighted Pools

Weighted Pools are pools in which the composition of the underlying assets in the pair can be made up of different weights other than 50/50 i.e 80/20

This is best used for pairs that have little or no price correlation as it reduces the effects of impermanent loss on LP providers and increases the amount of possible pairs there are.

Stable Pools

Stable Pools are the same as vanilla AMM pools where assets are weighted 50/50 between each other.

Stable Pools are most optimal for tokens such as stablecoins, wrapped assets, and staked derivatives. These pools allow pairs that are meant to trade close to (or at) parity to be exchanged with low price impact and low fees.

Liquidity Bootstrapping Pool (LPB)

LPBs use weighted pools to enable a pool that dynamically changes the weight of assets within the pool over time.

LBPs are used primarily for token launches, to allow for organic price discovery

Key Stats

ThalaSwap currently boasts a Total Value Locked (TVL) of USD 20.7 million, with the largest holding being in USDC (as reported by DeFi Llama), showcasing TVL stickiness.

Their leading pool currently is the $MOD/$USDC pool with USD 7.37m in TVL.

Move Dollar (MOD) - Aptos-native stablecoin

$MOD is Thala’s over-collateralized, yield-bearing stablecoin backed by a basket of on-chain assets. $MOD offers Aptos users a decentralized substitute for existing stable currencies. It also helps onboard more users to Aptos because $MOD's underlying mechanics offer an alternative risk profile to other decentralized choices.

Its diverse collateral base of liquid staked derivatives, liquidity pool tokens, deposit receipt tokens, and RWAs ensures its decentralized, censorship-resistant nature without compromising capital efficiency.

$MOD Vault Mechanics

How $MOD works:

Creating a Vault

Users create Vaults in which they deposit their collateral (e.g. $APT, wETH, USDC, USDT).

Minting (”Borrowing”) $MOD

The newly created vault is used to “mint” (borrow) $MOD.

There is a collateral ratio or CR that differs from asset to asset and this is based on Thala’s Collateral Risk Framework.

The amount that the user can “mint” will always be less than the value of the collateral so that the amount of collateral in the system always exceeds the value of $MOD in circulation.

Redemption

Users can redeem their 1 $MOD for $1 worth of collateral (minus redemption fees).

Liquidation

If the value of the user's collateral falls below the value of the $MOD then a liquidation process will occur. The liquidation system has two ways of liquidating someone whose Collateral Ratio (CR) has fallen below the Minimum Collateral Ratio (MCR).

TSP - Thala Stability Pool

Thala stability pools are designed to absorb debt arising from liquidations, creating a safeguard for the protocol's financial health. Users deposit $MOD into these pools and receive rewards in the form of collateral obtained from liquidations. This system guarantees the protocol's stability and maintains the overall support for $MOD.

PSM - Peg Stability Module

The Peg Stability Module (PSM) is one of the mechanisms responsible for maintaining the $MOD peg. The PSM is designed to facilitate fixed-rate swaps between stablecoins, with the express purpose of allowing for seamless arbitrage between MOD and other stablecoins.

The PSM has zero slippage, making it more attractive for arbitrageurs to use the PSM instead of the open market. The PSM functions like a vault with a 0% Stability Fee and 100% LTV. However, instead of users retaining ownership of their USDC while borrowing MOD, the USDC is swapped directly for MOD.

The primary benefit is that the risk-free, zero-slippage mechanic of the PSM allows for frictionless arbitrage, making it easier for arbitrage to take place on MOD.

ERM - Emergency Redemption Mode

ERM is a last-resort process that enforces the Target Price directly to MOD holders and Vaults. It shields Thala from attacks on its infrastructure during times of intense and prolonged market instability and irrationality. This activates a system-wide redemption mechanism.

Through ERM, MOD holders can redeem MOD for collateral directly after an Emergency Processing Period.

ThalaLaunch - Launchpad

ThalaLaunch is a decentralized launchpad that improves the previous model of ICOs ensuring equitable distribution and fair pricing while discouraging front-running for token launches on Aptos.

Under the hood, ThalaLaunch uses Liquidity Bootstrapping Pools (LBPs) to power its launchpad. LBPs are ThalaSwap weighted pools with special parameters:

Automatic adjusting weights: The pool automatically adjusts weights alongside the schedule.

Immutability: No one can ever deposit or remove liquidity from the pool after its creation.

How ThalaLaunch LBPs work:

In an LBP, there are two assets: the newly launching asset (token "A") with a decreasing pool weight, and a liquid asset (token "B") with an increasing pool weight. The person in charge of launching the token sets a couple of key parameters at the onset of the LBP: the start and end date of the LBP, the start and end weights, and the initial price of token “A”.

LBPs automatically adjust the weights of the pooled assets so that the price of token "A" depreciates throughout the LBP. However, as users buy the newly launched token, the price of token “A” will rise —similar to regular AMM pools. This back-and-forth of asset weight changes where the token weight changes over time (to bring the price of token “A” down), and trading volume occurs (to bring the price of token “A” up) helps to establish the fair market price of the token (token “A”).

Parliament - DAO governance platform

Parliament is a DAO governance platform allowing Aptos protocols and NFT communities to facilitate token governance. With Parliament protocols and NFT communities can establish spaces where members can use their governance tokens as voting power and decide on community proposals.

When Parliament launches, Thala will be the first protocol to integrate its governance, enabling veTHL holders to vote on important protocol issues. Parliament is an essential infrastructure for Aptos, as all Aptos-native communities and DAOs need ways to realize community members through token holdings.

thAPT (Liquid Staking)

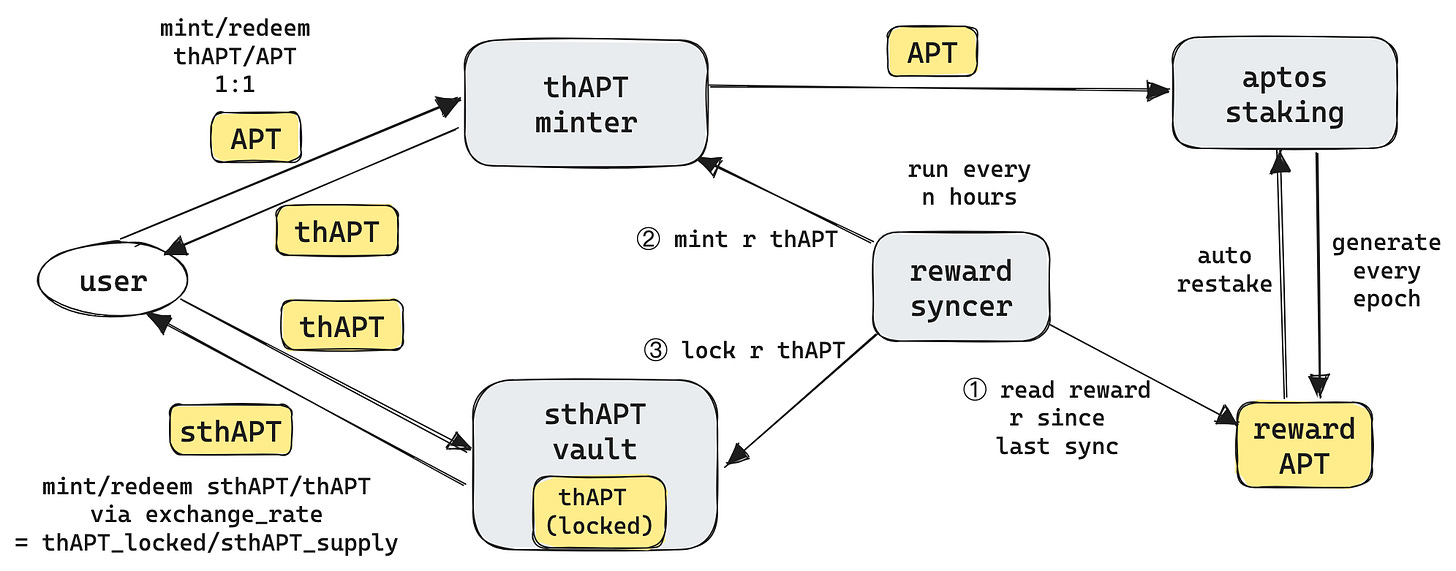

thAPT is Thala’s liquid staking derivative (LSD) to allow APT holders access to native yield from Thala’s APT validators. Thala’s LSD follows a two-token model:

thAPT - Deposit receipt that represents APT on Thala’s validator. thAPT is directly mintable against and redeemable for underlying APT at a 1:1 ratio.

sthAPT - Yield-bearing token that accrues interest from the staking yield of Thala’s APT validators. sthAPT is mintable by depositing thAPT into the Thala LSD module

Source: Thala Labs Documentation

Users can earn yield from Thala’s LSD in two different ways:

Stake thAPT for sthAPT (earning 80% of validator fees)

Provide Liquidity to the thAPT/APT liquidity pool (earning 20% of validator fees + swap fees + THL liquidity mining)

$THL Token

$THL is the governance token of Thala. When holders lock their THL for veTHL they can vote on protocol-wide changes, and receive rewards and other perks.

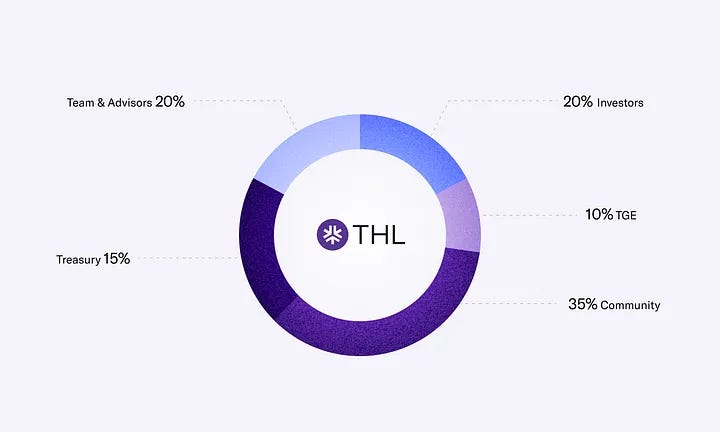

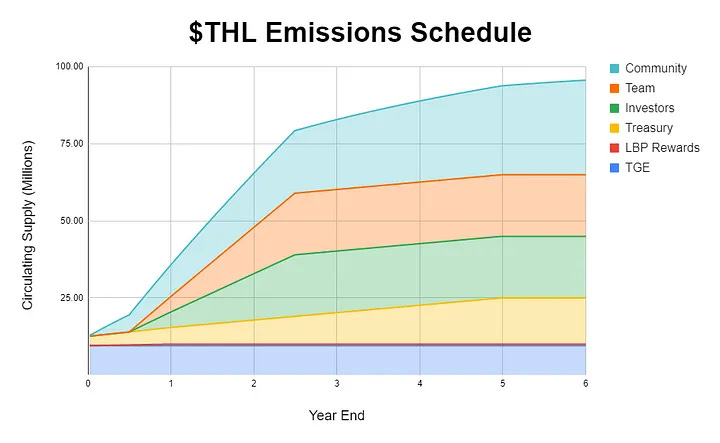

$THL Token Allocations & Emissions:

The total supply of $THL is 100,000,000 tokens distributed to the following groups:

Team & Advisors 20% (6-month lock-up, and 2-year linear vesting)

Investors 20% (6-month lock-up, and 2-year linear vesting)

TGE 10%

Treasury 15% (20% cliff at-start, and 5-year linear vesting)

Community 35%

Escrowed(es) THL (esTHL)

escrowed $THL ($esTHL) is an illiquid version of accrued $THL rewards. To convert $esTHL to the liquid $THL, users must vest their $esTHL for 90 days. However, users can exit their vesting period early at the cost of a 25% dynamic penalty on their accrued rewards (the penalty decreases linearly with the 90-day vest duration).

The penalty is redirected as follows:

50% distributed to veTHL holders proportional to their veTHL weights in liquid THL

25% to the ThalaDAO treasury for future initiatives such as community recognition rewards or treasury swaps if executed through governance

25% burned, to actively reduce the circulating supply of THL

Instead of exiting an active vesting position early and incurring a penalty fee, users also have the option to convert their esTHL to single-sided, 52-week locked veTHL at a 1:1 conversion ratio.

Vote-Escrowed(ve) THL (veTHL)

veTHL is created by locking THL or 80–20 THL-MOD liquidity pool tokens (LPT) for a duration of 1 to 52 weeks.

In return for locking THL or THL-MOD LPTs, users receive an amount of veTHL exponentially proportional to their lock time. However, THL/MOD LPT lockers are granted a 2.5x multiplier on received veTHL while THL depositors do not.

With veTHL, holders can direct AMM pool emissions, receive protocol fees, and participate in general governance decisions including:

Adjustments to protocol parameters such as swap fees, vault interest rates, mint fees, etc.

Contract upgrades that are executable only through governance to ensure the continued development of the protocol.

Treasury deployments, including treasury swaps with partner protocols, contributor compensation, audits, and more.

Additional product and cross-chain deployments to expand Thala’s product suite.

Ecosystem Initiatives

Thala Foundry (Aptos Incubator)

Thala Foundry is a DeFi incubator, launched in collaboration with the Aptos Foundation, aimed at supporting and expanding the Aptos ecosystem. Thala Foundry showcases Thala’s commitment to enhancing the on-chain economic activity of the Aptos network.

The initiative aims to foster inter-protocol synergies and support teams working on innovative primitives in various verticals, including asset origination, lending, synthetics, social and game finance, liquid staking derivatives, and infrastructure for Aptos DeFi.

With an initial funding of $1 million from Aptos, the incubator will provide financial support ranging from $50,000 to $250,000 to selected Aptos-native projects.

Thala Labs will actively assist these projects in areas such as fundraising, tokenomics design, protocol architecture, development, and security.

Thala Labs’ open-source initiatives

Thala has spearheaded a couple of open-source initiatives to further the development of Aptos and the Move language and reduce friction for developers building on Aptos.

Thala OSS

Thala OSS is a project to produce open-source software and enable greater developer adoption on Aptos and accessibility of the Move language. Thala OSS currently comprises 3 applications:

Thala Run - a smart contract runner and explorer on Aptos – an equivalent of Etherscan’s “Write Contract” functionality. The tool enables transactions to be included directly in the URL.

Thala Faucet - A faucet where users and builders can claim testnet tokens (WBTC, WETH, USDC, etc) for dApp development purposes

Thala FixedPoint64 - a Move library that implements fixed point numbers using the Q number format with u128 as the underlying data type. This makes more granular calculations possible, alongside accurate logarithmic and exponential calculations.

Surf

Surf is a set of type-safe TypeScript interfaces and React Hooks designed for Aptos. Surf improves upon the Aptos SDK by utilizing instant static type inference which eliminates the need for a code generation process.

Competitive Analysis

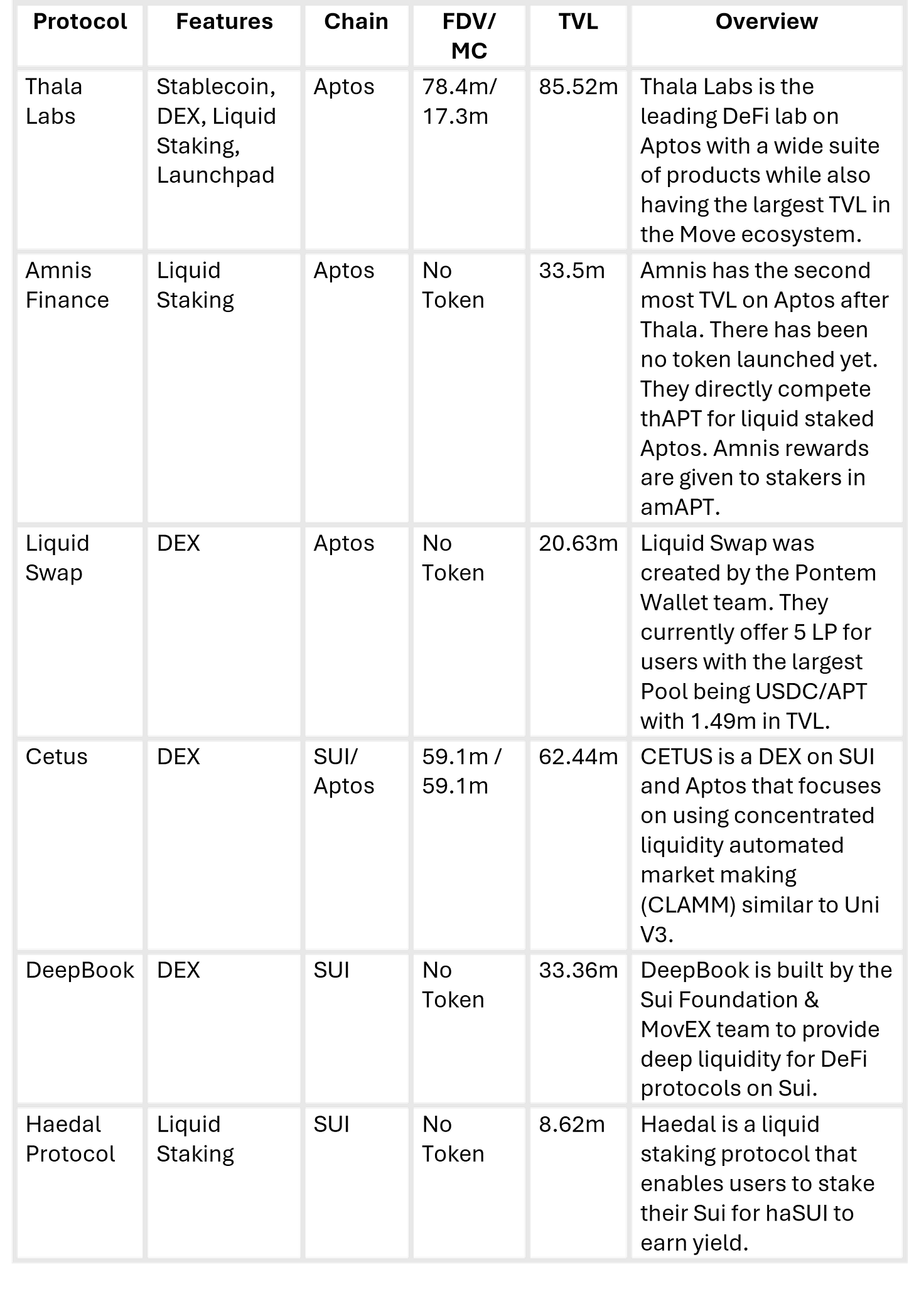

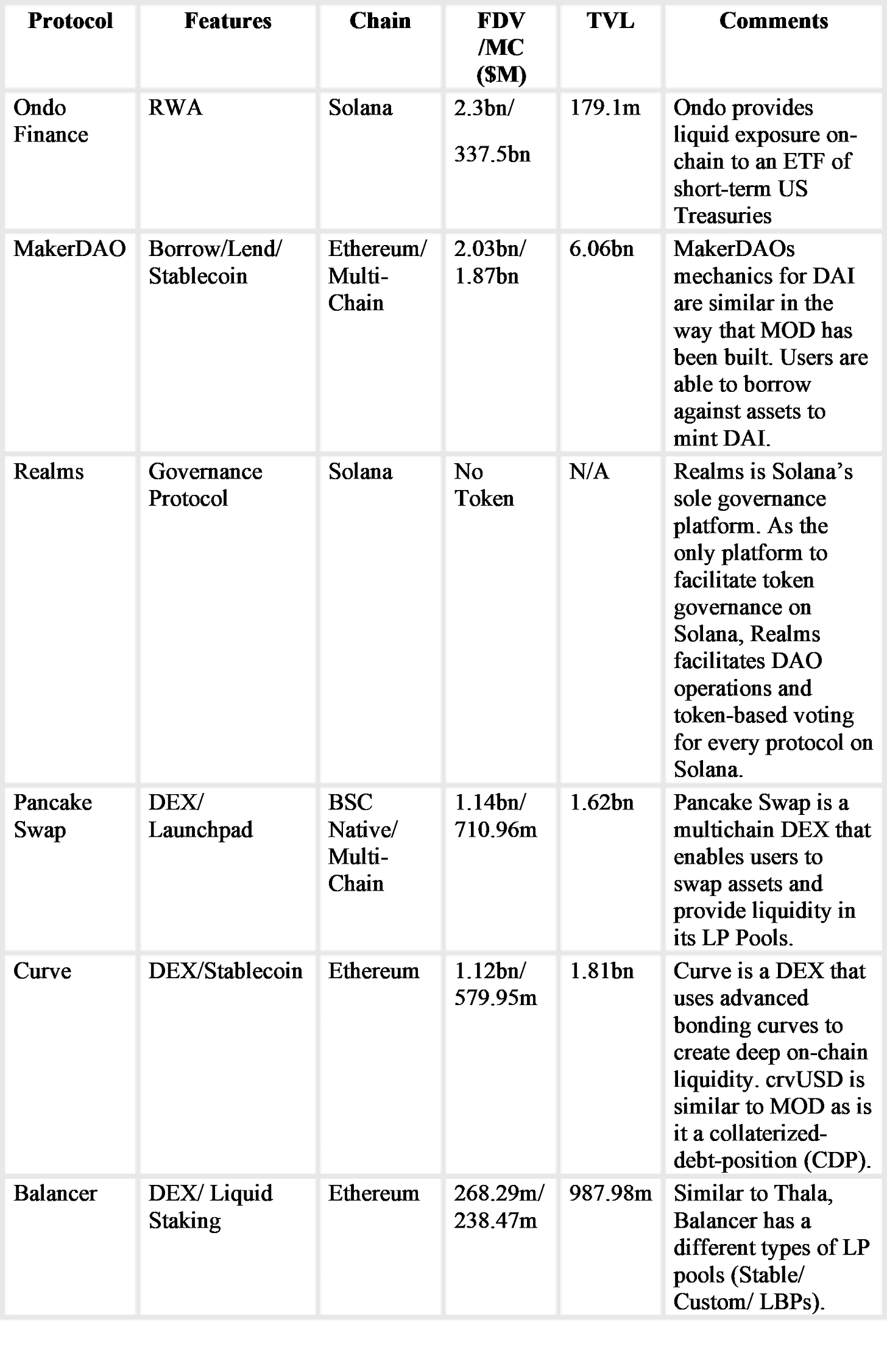

Thala Labs is the leader when it comes to building DeFi primitives on Aptos and any Move-based chain. They boast a TVL of $85.86m which is ~72% of Aptos’s total TVL. The next closest competitor in TVL is Amnis Finance with a TVL of $33.67m. It is hard to benchmark Thala’s valuation to similar products on Aptos and Sui as most of them haven’t released tokens. However, when compared to similar products on other chains, it does seem to reflect that the token is somewhat undervalued as they offer a wider range of products while holding a lot of the TVL on Aptos. In our opinion, a major factor that limits Thala’s growth in valuation is a lower adoption of Aptos and Sui, however, should this change then Thala’s valuation should have a lot of potential to grow.

Thala’s comprehensive range of products and partnership with Aptos Foundation has meant that they have absorbed the majority of the market share with the potential to remain the biggest Move-based project.

Move-Based Competitors

While Thala Labs currently lags behind its counterparts on EVM and Solana in terms of growth, the organization is poised for significant expansion. Its strategic focus on delivering essential infrastructure aligns with the increasing popularity of Aptos and the Move Language.

As the demand for Aptos rises, Thala is expected to experience parallel growth, positioning itself for a promising trajectory in the evolving landscape of blockchain technologies.

EVM/Solana Competitors

Conclusion

Thala's diverse product suite, coupled with the interconnectivity facilitated by the $THL token, positions the platform as a compelling contender, particularly if it ventures into cross-chain operations. Notably, the March 2023 partnership with LayerZero marked a significant development, transforming Thala's tokens $MOD and $THL into ominchain fungible tokens (OFT). This innovation allows seamless bridging of $MOD and $THL across chains without the need for wrapping, thanks to LayerZero's architecture.

While specific plans for cross-chain expansion have not been disclosed, the integration of LayerZero establishes Thala's capability to effortlessly migrate tokens across ecosystems when the need arises.

It’s also worth noting that the Aptos blockchain and the broader Move ecosystem are gaining momentum, showcasing significant growth potential. Noteworthy recent achievements for Aptos include:

DEX Volume hit an ATH of $6.47M on December 15th, 2023. Additionally, the average daily DEX volume on Aptos experienced a 169.6% increase MoM from November 2023 ($108,8629.1) to December 2023 ($293,5041.4).

Aptos TVL experienced a 140.2% increase over 1 year, growing from $51.92M on Jan. 15th, 2023 to $124.75M on Jan. 15th, 2024.

Daily Active Addresses hit an ATH of 613.9K on October 19th, 2023. Additionally, average Daily Active Addresses experienced a ~25% increase MoM from November 2023 (44,918) to December 2023 (56,468)

Thala Labs holds a TVL of $99.9m, accounting for 72.7% of Aptos’ TVL.

As Aptos steadily emerges as a prominent force, we anticipate Thala will emerge as the primary benefactor of this growth, solidifying its role as a foundational pillar that contributes liquidity, stability, and utility to the entire ecosystem.

Special Mention to

(DeFi Kai) for helping me with this writeup, check out some of his writing on his Substack as well as he has some great content!